liveforexsignals.online

Learn

How To Have Paypal Account

First and last name; Address; Phone number; Email address. For your protection, you'll also need to create a password for your account and choose 2 security. How to get started. · 1. Create Your PayPal Account · 2. Link your Credit/Debit Card · 3. Pay with PayPal. How do I sign up for an account with PayPal · Select Sign Up · Enter your email, phone number, and personal info · Link your bank or card to start sending. Head on over to PayPal, click Sign Up, choose your account type, and provide a name, an email address, and a password. That's it. It's as simple as that. 1. Click on the PayPal link on the merchant's website. Depending on how the website is designed, you may have to choose a "PayPal" option from a payment type. PayPal requires sign-up info & verification to prove financial ownership. Verification can be done by adding a bank account or applying for PayPal Credit. To get started setting up a PayPal account, go to liveforexsignals.online and click “Sign up” in the top right corner of the page. Enter your email and create a password for. Log in to your account. No need to expose your credit card info or fill out lots of forms. Just log in with your email address and password to complete your. Navigate to liveforexsignals.online · Click on Sign Up on the top right corner of your screen. · Choose Personal Account and click Next. · Choose your country of origin. First and last name; Address; Phone number; Email address. For your protection, you'll also need to create a password for your account and choose 2 security. How to get started. · 1. Create Your PayPal Account · 2. Link your Credit/Debit Card · 3. Pay with PayPal. How do I sign up for an account with PayPal · Select Sign Up · Enter your email, phone number, and personal info · Link your bank or card to start sending. Head on over to PayPal, click Sign Up, choose your account type, and provide a name, an email address, and a password. That's it. It's as simple as that. 1. Click on the PayPal link on the merchant's website. Depending on how the website is designed, you may have to choose a "PayPal" option from a payment type. PayPal requires sign-up info & verification to prove financial ownership. Verification can be done by adding a bank account or applying for PayPal Credit. To get started setting up a PayPal account, go to liveforexsignals.online and click “Sign up” in the top right corner of the page. Enter your email and create a password for. Log in to your account. No need to expose your credit card info or fill out lots of forms. Just log in with your email address and password to complete your. Navigate to liveforexsignals.online · Click on Sign Up on the top right corner of your screen. · Choose Personal Account and click Next. · Choose your country of origin.

You don't need a credit card to use PayPal. As long as you have a bank account, you can set up a PayPal account without a credit card or debit card. How to link PayPal to your account online · Sign in to Account Management and select Payment Method. · Select Add Payment Method > Add a PayPal Account. · Follow. How do I accept payments with PayPal without requiring clients to have a PayPal account? · 1. Login to your PayPal and go to Account Settings · 2. Select Website. PayPal is part of Samsung Pay, so you can store money and then use it when making purchases. You'll need to set up a PayPal account if you don't have one. Create your PayPal account for personal or business use. Send, receive, and manage your money all in one place. Get the app or sign up online today. According to PayPal, you must be at least 18 years of age to sign up for an account. The PayPal User Agreement states, “If you. What is PayPal? Discover what you can do with your PayPal account, money management, and sending money online, all from your digital wallet. How do I Connect my PayPal Account? (Marketplace) · Log into your BeatStars account. · Next, visit the following section: Payout Accounts. · Click the white. Yes, he can create an account in his name and let you use it. After you're 18, you can create your own account. You can't just change the name. To open a Personal account, you need to provide your: First and last name; Address; Phone number; Email address. For your protection, you'll also need to. If you use PayPal to Register Members online you can simply select PayPal when you get to the payment page, and then enter your. PayPal Username and Password to. How to get started with your PayPal account. Sign up to pay securely and have all your cards in one place when you shop online. If you are not registered in PayPal, select "Pay with a Bank Account or Credit Card". Pay with PayPal - Insert. How to send money through PayPal using your account · Step 1: Start the payment · Step 2: Select whether you're making a personal or business payment · Step 3. PayPal works as an intermediary between you and a bank. A user adds a bank account or credit/debit card to the PayPal system, and whenever they're making an. If you do not already have a PayPal Balance account you will link to this Card, visit liveforexsignals.online to get one, or you may get one when you activate this card. Once your account is set up, link your bank account or card by entering your bank details under "Link a bank" in the wallet section to enable. Linking your bank to PayPal on the website or in the app is a breeze. Instant or manual confirmation with small deposits. Up to 8 accounts can be linked. Merchants use a PayPal card reader in brick-and-mortar stores or enable Paypal as a payment option on their websites. Consumers can pay invoices and transfer.

What Is The Best Job In Real Estate

Arguably the most visible job on the list, real estate agents focus on listing and selling commercial and residential property. They often focus. Search Real estate jobs. Get the right Real estate job with company ratings & salaries. open jobs for Real estate. Top 10 entry-level jobs in real estate · 1. Real estate agent · 2. Real estate assistant · 3. Property management assistant · 4. Leasing consultant · 5. Real. There are always jobs in real estate. Real estate is the #1 driver of fortunes; 90% of all millionaires become so from real estate than from all other. So, are you still wondering if real estate is a good career path? With so much flexibility in terms of career paths, scheduling, autonomy, and income, a real. Different Real Estate Jobs · Appraiser · Community Development Manager · Foreclosure Specialist · Property Manager · Broker · Agent · Leasing Consultant. Real estate agent. General contractor or property manager would be fine too. If you were any one of these three you could simply hire the other. Companies That Hire for Remote Real Estate Jobs · 1. Doma Holdings · 2. eXp Realty · 3. HomeLister · 4. JobTracks · 5. Locale Hospitality · 6. Mometrix Test. Venturing into cleaning services is a great way of utilizing real estate contacts who are constantly in need of clean properties. Especially when the global. Arguably the most visible job on the list, real estate agents focus on listing and selling commercial and residential property. They often focus. Search Real estate jobs. Get the right Real estate job with company ratings & salaries. open jobs for Real estate. Top 10 entry-level jobs in real estate · 1. Real estate agent · 2. Real estate assistant · 3. Property management assistant · 4. Leasing consultant · 5. Real. There are always jobs in real estate. Real estate is the #1 driver of fortunes; 90% of all millionaires become so from real estate than from all other. So, are you still wondering if real estate is a good career path? With so much flexibility in terms of career paths, scheduling, autonomy, and income, a real. Different Real Estate Jobs · Appraiser · Community Development Manager · Foreclosure Specialist · Property Manager · Broker · Agent · Leasing Consultant. Real estate agent. General contractor or property manager would be fine too. If you were any one of these three you could simply hire the other. Companies That Hire for Remote Real Estate Jobs · 1. Doma Holdings · 2. eXp Realty · 3. HomeLister · 4. JobTracks · 5. Locale Hospitality · 6. Mometrix Test. Venturing into cleaning services is a great way of utilizing real estate contacts who are constantly in need of clean properties. Especially when the global.

Real Estate jobs in Houston, TX need you! Apply today and take the next step in your career. A whopping 98% of more than real estate agents surveyed agree that a career in real estate offers them good flexibility. Not only can you choose among. Certified Commercial Investment Member (CCIM) is a great, well rounded, series of classes that teaches financial and marketing methods for our industry. Society. Paying close attention to the details is imperative for your real estate career. A successful real estate agent is attentive to the unique needs of their. Real Estate Agents made a median salary of $49, in The best-paid 25% made $78, that year, while the lowest-paid 25% made $36, Real estate brokers and sales agents help clients buy, sell, and rent properties. Brokers and agents do the same type of work, but brokers are licensed to. 1. TRAVEL and tourism CAREERS. To pursue a career in real estate, professionals need to know how to market a demographic area. · 2. Marketing or human resources. Search and apply for commercial real estate jobs, from entry-level to executive. Employers can post a job across 12 real estate associations in one click to. Our agents sell more homes in one year than most do in three. Joining REALTEAM Real Estate might just be the best decision you make as you pursue your real. While the real estate industry is expected to have a 5% growth in overall employment from to , and the job outlook remains steady, home. Arguably the most visible job on the list, real estate agents focus on listing and selling commercial and residential property. They often focus. Having said that, Real Estate is a dog-eat-dog world. That is not to say that brokers/agents are bad. In fact, they are some of the most honest. Real estate jobs are some of the highest-paid jobs. However, real estate professions do not only involve helping people buy and sell property there are also. Yes, real estate agent jobs are in demand. Real estate agent demand is projected to grow 5% from to See Expert Opinions On The Job Outlook For Real. Coldwell Banker Kaljian & Associates. Real Estate Agent - Realtor · Home & Slate Real Estate · Hyatt Vacation Ownership Logo · C2 Realty Group Logo · The sterling. Then take that real estate professional out to lunch to discuss the local real estate business. They can give you great insight on offices, jobs. Find the best Remote Real Estate jobs. It takes just one job to develop a successful relationship that can propel your career forward. Find work Interested. Based on 10 responses, the job of Real Estate Agent has received a job What is the highest pay for Real Estate Agents? Our data indicates that the. In Real Estate, the title with the most salary potential is often 'Managing Broker' or 'Principal Broker'. These roles involve not only buying and selling. Because the broker has the education, experience, and a license to conduct real estate transactions, they are the best-qualified to handle all details, except.

Add Money Walmart Card

Direct Deposit your pay or government benefits. Add money to your card from your existing bank account. Free cash reloads with app at Walmart stores nationwide. Simply swipe or insert your debit card, hand the cash to your Walmart cashier and the money will be loaded into your checking account. *$2 per transaction. The MoneyCard can be loaded at store registers, at Walmart MoneyCenters, or with your Internal Revenue Service (IRS) tax refund, among others. MoneyCard. You can add cash at other locations for up to $ As of July 1, , cash reloads at Walmart will no longer be free and will incur a fee of $ per. With your Walmart MoneyCard in hand, tell the Associate how much you want to add to your account. You can add $$1, to your card Easily manage & access your money. New Walmart MoneyCard accounts now get: Get your pay up to 2 days early with direct deposit. ¹. Earn cash back. This article provides step-by-step instructions on how to quickly and easily load your walmart money card into your bank account. 3% Cash Back at Walmart is only available to eligible customers who have a qualifying account balance or meet a direct deposit minimum, and is limited to an. Open a new card, add $50+ & be automatically entered for a chance to win $*. Open an account. Earn up to $75 cash back each year on Walmart purchases.¹. Direct Deposit your pay or government benefits. Add money to your card from your existing bank account. Free cash reloads with app at Walmart stores nationwide. Simply swipe or insert your debit card, hand the cash to your Walmart cashier and the money will be loaded into your checking account. *$2 per transaction. The MoneyCard can be loaded at store registers, at Walmart MoneyCenters, or with your Internal Revenue Service (IRS) tax refund, among others. MoneyCard. You can add cash at other locations for up to $ As of July 1, , cash reloads at Walmart will no longer be free and will incur a fee of $ per. With your Walmart MoneyCard in hand, tell the Associate how much you want to add to your account. You can add $$1, to your card Easily manage & access your money. New Walmart MoneyCard accounts now get: Get your pay up to 2 days early with direct deposit. ¹. Earn cash back. This article provides step-by-step instructions on how to quickly and easily load your walmart money card into your bank account. 3% Cash Back at Walmart is only available to eligible customers who have a qualifying account balance or meet a direct deposit minimum, and is limited to an. Open a new card, add $50+ & be automatically entered for a chance to win $*. Open an account. Earn up to $75 cash back each year on Walmart purchases.¹.

To add money to a prepaid Walmart debit card, you can follow these steps: 1. Visit any Walmart store near you. 2. Locate the MoneyCenter or. I love it. I get my deposit 5 days early but I got the same from others. The money card works beautifully with deposit coming at the same. Direct Deposit your paycheck, tax refunds or other recurring payments; Transfer from a bank account; Add cash at Walmart or Sam's Club locations or a cash. Use it to securely store your debit, credit, & Walmart gift card information. You'll use your smartphone to check out instead of pulling out your cards, cash. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. Log into the Walmart MoneyCard app and tap deposit to deposit cash, which will create a deposit code to deposit cash at a Walmart store. OneUnited Bank offers Green Dot® services to deposit cash on the go (reloading), including Reload @ the Register™, Walmart® Rapid Reload, and MoneyPak®!Now it's. Send money, cash checks, pay bills, & more. Additional card benefits. Walmart MoneyCard. Unlock overdraft protection with opt-in & eligible direct deposit. Walmart check cashing fees may also apply. Where can I deposit a check to my debit or prepaid card account? You can cash a pre-printed payroll or government. Give the amount of cash you wish to add to the cashier (as well as any necessary fees), swipe your card or scan your barcode, and your money is immediately. Send money, cash checks, pay bills, & more. Additional card benefits. Walmart MoneyCard. Unlock overdraft protection with opt-in & eligible direct deposit. 1. Visit any Walmart store near you. 2. Locate the MoneyCenter or Customer Service desk within the store. 3. Bring your prepaid Walmart debit. In addition to adding money at Walmart, you can also add money using a MoneyPak that may be purchased at other retailers, such as grocery. It's easy - just select the debit option at check out. Load cash. Use Direct Deposit. Safe and easy. Use your Account to manage all your money. Set up direct. In-Store · Sign into your liveforexsignals.online account. · Scan the on-screen QR code to connect to your account. · Select Walmart Cash as a payment method. · Select payment. Easily manage & access your money. New Walmart MoneyCard accounts now get: • Get your pay up to 2 days early with direct deposit.¹ • Earn cash back. This article will provide a detailed, step-by-step guide on how to transfer money from your Walmart Money Card to Cash App, ensuring a smooth and successful. Inserted the card on the terminal, handed over cash. Voila! Done. Cash immediately deposited to my account for use. How do I deposit cash with my One debit card at Walmart? · Take your One debit card to any Walmart Money Center, cashier, or Customer Service Desk · Let the. Add cash to any eligible prepaid or bank debit card. · How it works · There are so many ways to use MoneyPak.

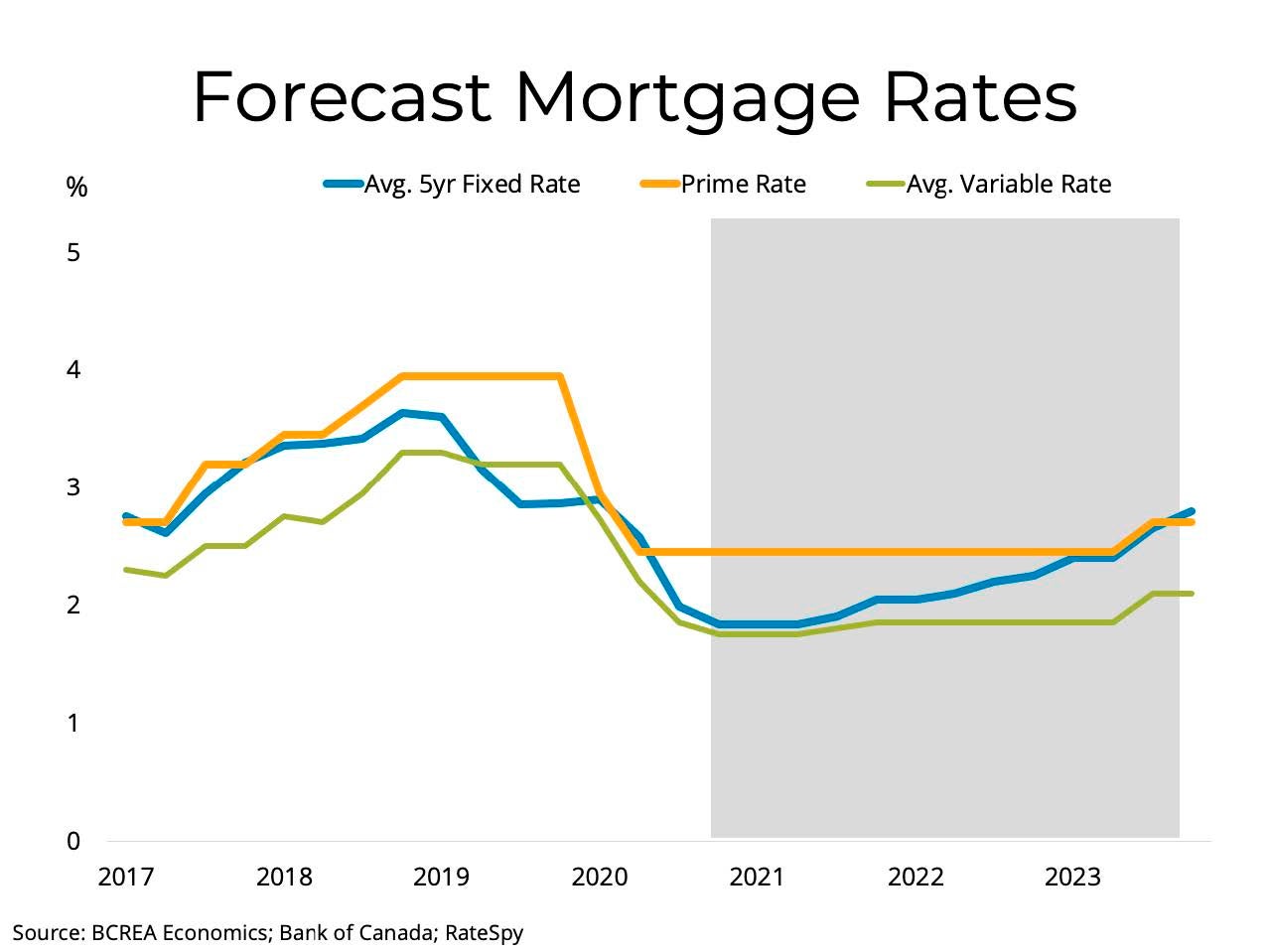

Current 3 Year Mortgage Rates

Compare current 3-year ARM rates from multiple lenders to find the best ARM rate. Get customized quotes for your 3-year ARM loan. Fixed Rate Closed Mortgages ; 3 Year Fixed Closed. Posted rate: % Special rate: % · APR: % ; 4 Year Fixed Closed. Posted rate: % APR: % ; 5. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Since then, Zillow reported that rates for 3/1 ARMs averaged % at the end of January in 3/1 Adjustable-Rate Mortgage Rates*. Year, Average Annual. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. Here are the average annual percentage rates (APR) today on year, year and 5/1 ARM mortgages. Fixed and Variable Closed ; % · % · RBC Prime Rate - % (%) ; % · % · %. For today, Friday, September 06, , the current average interest rate for a year fixed mortgage is %, unchanged from a week ago. If you're in the. Compare current 3-year ARM rates from multiple lenders to find the best ARM rate. Get customized quotes for your 3-year ARM loan. Fixed Rate Closed Mortgages ; 3 Year Fixed Closed. Posted rate: % Special rate: % · APR: % ; 4 Year Fixed Closed. Posted rate: % APR: % ; 5. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Since then, Zillow reported that rates for 3/1 ARMs averaged % at the end of January in 3/1 Adjustable-Rate Mortgage Rates*. Year, Average Annual. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. Here are the average annual percentage rates (APR) today on year, year and 5/1 ARM mortgages. Fixed and Variable Closed ; % · % · RBC Prime Rate - % (%) ; % · % · %. For today, Friday, September 06, , the current average interest rate for a year fixed mortgage is %, unchanged from a week ago. If you're in the.

On Thursday, Sept. 5, , the average interest rate on a year fixed-rate mortgage dropped 15 basis points to % APR. The average rate on. Today's posted rates ; Fixed Rate Closed Mortgage · 1 year, % ; Variable Rate Mortgage · 3 year (open), % ; Convertible Fixed Rate Mortgage. year fixed, % (%), $1, added to closing costs, $2, ; year fixed, % (%), $ credit to closing costs, $2, Today's year fixed mortgage rates. % Rate. % APR. Learn how Any such offer may be made only pursuant to subdivisions 3 and 4 of Minnesota. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Thursday. Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. For today, Thursday, September 05, , the national average 5/1 ARM interest rate is %, down compared to last week's of %. The national average 5/1. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. By July , the year fixed rate fell below 3% for the first time. And it kept falling to a new record low of just % in January The average. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. On the refinance side however, homeowners who bought in recent years are taking advantage of declining mortgage rates in order to lower their monthly payments. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. For a year loan of $,, you would make 84 payments of $ 1, at % APR, followed by payments based on the then-current variable rate. Loan. Historical Mortgage Rates ; , , , , ; , , , ,

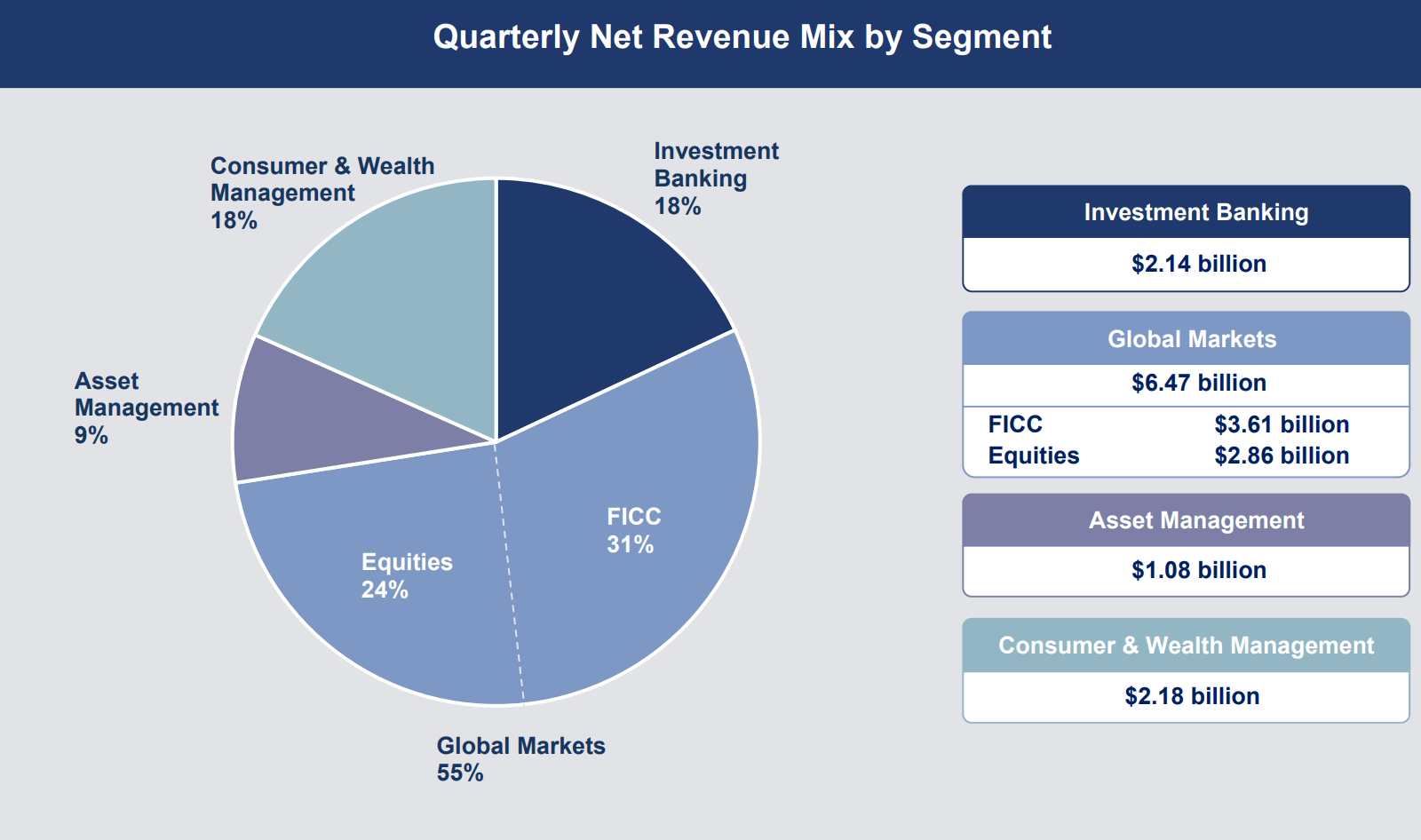

Goldman Sachs Recommended Stocks

Is Goldman Sachs One of the Top Bank Stocks to Buy Now? Aug. 26, at a.m. ET on Motley Fool. 1 Warren Buffett Stock to Hedge Against an Overheated. Goldman Sachs leaders, investors, and analysts break down the key issues moving markets in our weekly podcast The Markets. Can the US consumer stay strong? Will the rebound in Chinese stocks continue? Taking stock: Can the US rally continue? What could drive the S&P even. These are the so-called “GRANOLA” stocks – GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP, and Sanofi – stocks with strong. securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes. The Goldman Sachs Group, Inc., a bank holding company, is a global investment banking and securities firm specializing in investment banking, trading and. GS average Analyst price target in the past 3 months is $ Find stocks in the Financial sector that are highly recommended by Top Performing Analysts. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq Back to Top «. WSJ Membership. The Journal Collection · Subscription Options. ANALYST RECOMMENDATIONS: Colgate, Lockheed Martin, Procter & Gamble, Eli Lilly, Tesla Jul. 24 Our Logo. Redburn Atlantic Adjusts Price Target on Goldman. Is Goldman Sachs One of the Top Bank Stocks to Buy Now? Aug. 26, at a.m. ET on Motley Fool. 1 Warren Buffett Stock to Hedge Against an Overheated. Goldman Sachs leaders, investors, and analysts break down the key issues moving markets in our weekly podcast The Markets. Can the US consumer stay strong? Will the rebound in Chinese stocks continue? Taking stock: Can the US rally continue? What could drive the S&P even. These are the so-called “GRANOLA” stocks – GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP, and Sanofi – stocks with strong. securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes. The Goldman Sachs Group, Inc., a bank holding company, is a global investment banking and securities firm specializing in investment banking, trading and. GS average Analyst price target in the past 3 months is $ Find stocks in the Financial sector that are highly recommended by Top Performing Analysts. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq Back to Top «. WSJ Membership. The Journal Collection · Subscription Options. ANALYST RECOMMENDATIONS: Colgate, Lockheed Martin, Procter & Gamble, Eli Lilly, Tesla Jul. 24 Our Logo. Redburn Atlantic Adjusts Price Target on Goldman.

Goldman Sachs cuts India's 20GDP growth forecasts · Hot stocks: Brokerage view on Aavas Financiers, ONGC and Honasa · Eicher Motors shares jump 5% on. Goldman Sachs Group (NYSE: GS). $ (%). -$ Price as of August engages in global investment banking, securities, and investment management, which provides financial services. Top College Football Players To Look Out For. Goldman Sachs offers services in investment banking (advisory for mergers and acquisitions and restructuring), securities underwriting, prime brokerage, asset. The Goldman Sachs Global Banking & Markets business produces trade ideas and sales notes with respect to equities, fixed income securities, derivatives and. Goldman Sachs' Top Trades To Hedge A Stock Market Drop · Mentioned in story · RBLX · Roblox Corporation · ROKU · Roku Inc · IAC · IAC Inc. Albemarle, Hasbro, Citigroup, Goldman Sachs, Dow Inc., and Albemarle are stocks 22V Research sees as benefiting from falling rates, and a strengthening economy. Goldman Sachs Group (GS) has a Smart Score of 6 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. A month ago, Strong Buy made up %, while Buy represented %. Broker Rating Breakdown. Broker Rating Visualization. Brokerage Recommendations. Today, 1. Want to trade stocks and other assets? Don't lose hundreds of dollars in Lowest: Median: Highest: *The average price target. Top 5 stock holdings are SPY, NVDA, MSFT, AAPL, AMZN, and represent % of Goldman Sachs Group's stock portfolio. · Added to shares of these 10 stocks: NVDA. Member Sign In · The Goldman Sachs Group (GS) · Broker Recommendations · GS +(%) · About Broker Recommendations · Zacks News for GS · Why Is Goldman . View Goldman Sachs Group, Inc. GS stock quote prices, financial information Stocks About to Face Economic Reality? by TipRanks Jul 30 am ET. · Future Index. · Barron's · Market Data; /; Stocks; /; GS; /; Research & Ratings. Goldman Sachs Group Inc. U.S.: NYSE. We are increasing our fair value estimate for narrow-moat-rated Goldman Sachs to $ from $ per share. This is about 12 times forward earnings and Citigroup Issues New Preferred at 7%. Morgan Stanley Sells Its Deal at %. July 23, a.m. ET. 10 Top Stocks That Can Hold. analyst estimates, including GS earnings per share estimates and analyst recommendations Here's Who Could Benefit. Home · Investing · Quotes · Stocks · United. According to the 18 analysts' twelve-month price targets for The Goldman Sachs Group, the average price target is $ The highest price target for GS is. Goldman Sachs Group Inc GS:NYSE ; after hours icon After Hours: Last | PM EDT. UNCH (UNCH) ; Volume. 12, Is Goldman Sachs One of the Top Bank Stocks to Buy Now? The Motley Fool Ratings are not recommendations to purchase, hold, or sell securities, and.

Penny Stocks Dow Jones

Dow at New Record Despite Downward Spin by Nvidia. Equinox, Celestica in Forefront. The Dow Jones Industrials rose to a record high Thursday, as Wall Street. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. The stock's market capitalization was only $,, and it had just million shares in float. Both those factors add risk for an investor. While many penny-. In the UK, a penny stock is defined as any share worth less than £1 each. In the US it's any under US$5 (circa AUD$7). In Australia, many classify penny stocks. S&P , Dow Jones and Nasdaq composite posted record jump as Nvidia, Microsoft and Alphabet pushed US Stock Market and Wall Street higher o 20 Aug, Is it possible to make money on the stock market with a small amount of money? If yes, how can we start it without losing our investment? Top NASDAQ / NYSE Penny Stock List: ; DNN, Denison Mines Corp, NYSEAMERICAN ; CGC, Canopy Growth Corporation, NASDAQ ; TUP, Tupperware Brands Corporation, NYSE. A penny stock is any stock that trades at $5 and under. Most sub-1 penny stocks are not trading on major exchanges. As a result, they're not subject to SEC. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. Dow at New Record Despite Downward Spin by Nvidia. Equinox, Celestica in Forefront. The Dow Jones Industrials rose to a record high Thursday, as Wall Street. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. The stock's market capitalization was only $,, and it had just million shares in float. Both those factors add risk for an investor. While many penny-. In the UK, a penny stock is defined as any share worth less than £1 each. In the US it's any under US$5 (circa AUD$7). In Australia, many classify penny stocks. S&P , Dow Jones and Nasdaq composite posted record jump as Nvidia, Microsoft and Alphabet pushed US Stock Market and Wall Street higher o 20 Aug, Is it possible to make money on the stock market with a small amount of money? If yes, how can we start it without losing our investment? Top NASDAQ / NYSE Penny Stock List: ; DNN, Denison Mines Corp, NYSEAMERICAN ; CGC, Canopy Growth Corporation, NASDAQ ; TUP, Tupperware Brands Corporation, NYSE. A penny stock is any stock that trades at $5 and under. Most sub-1 penny stocks are not trading on major exchanges. As a result, they're not subject to SEC. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other.

Timothy Sykes is a millionaire penny stock trader and entrepreneur. He is best known for earning $ million by day trading while attending Tulane. Penny stocks are common shares of smaller companies traded for less than £1 in the UK and below $5 in the US. The market cap on penny stock companies is. Stock Market Snapshot. World Indices. Americas · Asia/Pacific · Europe · Middle East/Africa. U.S. Indices. Dow Jones Industrial Average · S&P Exchange. Intouch Insight offers customer experience management products and services helping clients quantify customer satisfaction and understand stock market trends. A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. That can be very dangerous in the stock market. License Error: Access from crawling bot. #5: Caremax Inc (NASDAQ: CMAX) —. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. You can't beat Dow Jones stocks for stability and defense in a down market. By the same token, the blue chip average won't always keep up in a rising market. Benefit from the dual advantage of impressive capital gains and exposure to the high-potential penny stock market by investing in these high-performing stocks. Penny stocks, occasionally referred to as “micro-cap” or “nano-cap” stocks are low-value stocks representing smaller companies traded on the stock market. As. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · liveforexsignals.online (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc.. Penny stocks can be an excellent way for first-time investors to learn about the stock market, trading practices, and investment strategies without committing. Penny stocksPink sheetOverboughtOversoldAll-time highAll-time lowweek highweek low · Create more lists in Screener. Most volatile US stocks. Market. liveforexsignals.online, A leading site for news and information on small caps, penny stocks and microcaps is adding Dow Jones Industrial Average · Education. There's a saying in the stock market: Follow the smart money. When a major investor makes a move on a low-priced stock, it can often lead to substantial price. 3 Penny Stocks to Watch Now, 6/25/ 2M ago. NXL · AREB. Show More. Trending. Indices. Stocks. ETFs. Name. Price. Price Change. SPX. S&P DJIA. Dow Jones. Stock Operator. -- Dow Jones Newswire. About the Author. Timothy Sykes is an American hedge fund manager and star of the television documentary Wall Street. Penny stocks in the Indian stock market can have prices below Rs These US stock market Thursday: Dow Jones sets new record, S&P , Nasdaq down. Dow Jones Futures · S&P Futures · Nasdaq Futures · S&P · Dow Jones · Nasdaq United States Stocks Dow Jones S&P Nasdaq Nasdaq. Pre Market.

Do You Have To Wait To Refinance

Seasoning refers to the minimum period you must wait before refinancing. Ensuring you've made consistent payments on your existing loan during this seasoning. Often, you can refinance for better rates and secure new loan terms that better fit your lifestyle. When looking into RV refinancing, there are a few things to. You can usually do a no-cash-out refinance of a conventional mortgage immediately after closing on the original home loan. But some lenders set waiting periods. It depends on when your refinance is scheduled to close. Learn how to make the best decision based on where you are in the closing process. Yes, refinancing in your situation is a no-go until rates come down to at or below % (1% less than your current rate is the general rule of thumb). Refinancing your auto loan so you have a lower monthly payment can make sense if your income has dipped. The lower payment can help ease the strain on your. Although you can technically refinance immediately, some lenders may require you to wait months before refinancing with the same company. If taking advantage of. The new lender you choose will need to see the title to do a refinance. Waiting longer, such as six months to a year, will give your credit score a chance to. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within to days of issuing. Seasoning refers to the minimum period you must wait before refinancing. Ensuring you've made consistent payments on your existing loan during this seasoning. Often, you can refinance for better rates and secure new loan terms that better fit your lifestyle. When looking into RV refinancing, there are a few things to. You can usually do a no-cash-out refinance of a conventional mortgage immediately after closing on the original home loan. But some lenders set waiting periods. It depends on when your refinance is scheduled to close. Learn how to make the best decision based on where you are in the closing process. Yes, refinancing in your situation is a no-go until rates come down to at or below % (1% less than your current rate is the general rule of thumb). Refinancing your auto loan so you have a lower monthly payment can make sense if your income has dipped. The lower payment can help ease the strain on your. Although you can technically refinance immediately, some lenders may require you to wait months before refinancing with the same company. If taking advantage of. The new lender you choose will need to see the title to do a refinance. Waiting longer, such as six months to a year, will give your credit score a chance to. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within to days of issuing.

While not common, some lenders may penalize you for refinancing before your loan terms are up. Prepayment penalties may cancel out any cost savings you achieve. As a rule, you have to wait six months after you've gotten a mortgage to refinance. And interest rates aren't the only factor in refinancing – there are costs. A good rule of thumb is to wait until rates are at least 1% lower than your current rate before you refinance. Typically, you must wait at least six months after a home purchase to refinance with a cash-out. You'll also want to make sure you have enough equity and it's a. In most cases, you can refinance a car immediately after purchasing it as long as you meet all of the qualifications. However, the best time to refinance a car. After you buy a car, you have to wait at least 60 to 90 days before you can refinance, since it takes about this long to transfer the title to your name. Refinancing at the right time can help you save money, either by lowering your mortgage payments or by reducing the amount of interest you'll pay over the life. The economy can change in the blink of an eye, and if mortgage interest rates in your area have plummeted since you bought your home, you may consider. You will need to wait until the refinance closes to receive your funds if you're refinancing your primary home for a second home down payment. Generally, it. This depends on a number of factors, including current mortgage rates, how much equity you have in the house (i.e. how much of the loan you've already paid off). When it comes to refinancing a USDA home loan, the borrower typically must wait a year before making a request and be current for the last days. In summary. You'll likely need to wait a year for a conventional or FHA cash-out refinance. These rules have some limited exceptions, including if you're taking advantage. The waiting period between taking out a mortgage and being eligible for a refinance varies by loan program. Some home loans qualify for refinancing right away. So we can see that for FHA cash-out refinance loans, the minimum wait time is days but contingent on the payments being made on time. For FHA refi loans. How Long Should You Wait to Refinance an Auto Loan? If you're interested in car loan refinancing, you may submit an auto refi loan application with a lender. Although you can technically refinance immediately, some lenders may require you to wait months before refinancing with the same company. If taking. If you refinance to a lower interest rate, your monthly payment will likely shrink. You can put those savings toward other expenses or apply it toward your. For conventional loans (i.e. loans backed by Fannie Mae or Freddie Mac), you'll need to take your mortgage out of forbearance and make three consecutive. In some cases, you may want to wait to refinance so you can improve your debt-to-income (DTI) ratio, build up your home equity, or increase your credit score to. In short, it depends on the kind of loan you have. Conventional loans, such as a or year mortgage, have no waiting period to refinance. This means.

Managing By Objectives

MBO is an acronym for management by objectives, a systematic managerial approach introduced by corporate management expert Peter Drucker in Need for Management by Objectives (MBO) · The Management by Objectives process helps the employees to understand their duties at the workplace. · KRAs are. MBO is an established methodology that helps leaders create specific, strategic goals. It enables businesses to move away from vague goal-setting. MBO relies on the defining of objectives for each employee and then to compare and to direct their performance against the objectives which have been set. It. The MBO process, in its essence, is an effort to be fair and reasonable, to predict performance and judge it more carefully. In summary, the impact of MBO system depends strongly on the design and implementation of its features. If it based on the standard, good practice and principle. Learn the 6 steps of the Management by Objectives process, and how to use them to boost performance by aligning people's actions with organization goals. Managing by Objectives (Management Applications Series) [Raia, Anthony P.] on liveforexsignals.online *FREE* shipping on qualifying offers. Managing by Objectives. MBO is a management technique that uses strategic planning to set clear and measurable objectives between employees and the business and monitors progress. MBO is an acronym for management by objectives, a systematic managerial approach introduced by corporate management expert Peter Drucker in Need for Management by Objectives (MBO) · The Management by Objectives process helps the employees to understand their duties at the workplace. · KRAs are. MBO is an established methodology that helps leaders create specific, strategic goals. It enables businesses to move away from vague goal-setting. MBO relies on the defining of objectives for each employee and then to compare and to direct their performance against the objectives which have been set. It. The MBO process, in its essence, is an effort to be fair and reasonable, to predict performance and judge it more carefully. In summary, the impact of MBO system depends strongly on the design and implementation of its features. If it based on the standard, good practice and principle. Learn the 6 steps of the Management by Objectives process, and how to use them to boost performance by aligning people's actions with organization goals. Managing by Objectives (Management Applications Series) [Raia, Anthony P.] on liveforexsignals.online *FREE* shipping on qualifying offers. Managing by Objectives. MBO is a management technique that uses strategic planning to set clear and measurable objectives between employees and the business and monitors progress.

Management by Objectives and the Balanced Scorecard. Management by Objectives is very similar to the Balanced Scorecard approach, as mentioned earlier in the. MBO is an performance management approach in which a balance is sought between the objectives of employees and the objectives of an organization. MBO in sales - usage, benefits and disadvantages. Management By Objectives(MBO) is a way to manage and evaluate sales teams. However, business environments. Management by objectives (MBO) is a process in which a manager and an employee agree on specific performance goals and then develop a plan to reach them. Management by objectives is the process of defining specific objectives within an organization that management can convey to organization members. MBO is an established methodology that helps leaders create specific, strategic goals. It enables businesses to move away from vague goal-setting. Management by Objectives (MBO) and Results-Based Management (RBM) are both approaches to management that focus on achieving specific goals. Management by objectives (MBO) is a systematic and organized approach that allows management to focus on achievable goals and to attain the best possible. MBO aims to increase organizational performance by aligning the subordinate objectives throughout the organization with the overall goals that management has. MBO is a management system that aims to align an organization's goals and objectives with the actions of its employees. It is a process that involves setting. Management by Objectives (MBO) definition, limits and benefits. MBO is a business management method based on the clear and precise definition of individual and. The approach focuses on setting clear, achievable objectives that align with organizational goals, thereby enhancing performance and productivity. Both MBO and OKR goal setting declare objectives and allow teams to figure out how they achieve them. Learn the differences and which is right for your. Management by objectives (MBO), as the name suggests, is a method of enhancing how the company goals and strategies are understood by the. MBO emphasizes setting clear goals, involving employees in decision making, and connecting performance evaluations to goal achievement. Management by objectives (MBO) is a systematic and organized approach that allows management to focus on achievable goals and to attain the best possible. MBO relies on the defining of objectives for each employee and then to compare and to direct their performance against the objectives which have been set. It. MBO aims to increase organizational performance by aligning the subordinate objectives throughout the organization with the overall goals that management has. The MBO process typically involves three stages: goal setting, developing action plans, and reviewing performance. Goals are set based on specific, measurable. Management by Objectives (MBO) focuses on management and employees setting agreed upon objectives completed through a five-step process that includes.

Credit Score To Get New Car

Lenders look at individuals with high credit scores as a low-risk of defaulting on payments, and will offer lower interest rates as a reward for good credit. Lenders offering car loans to people with a credit score may have specific requirements, such as a stable income, a down payment, or a co-signer to mitigate. What Credit Score Do I Need to Get a Good Deal on a Car? To get an auto loan without a high interest rate, our research shows you'll want a credit score of Auto Loan Tiers Based on Credit Scores · Super Prime rates are reserved for those with credit scores between · Prime rates are for those with a FICO. If you're in the market for a new vehicle, or even a used vehicle, you're probably wondering what kind of credit score you'll need to finance a car. Average Credit Score For Car Financing On average, Hendersonville drivers who are shopping for a new car have a credit score of for a new vehicle and As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able. Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. It's very possible to buy a car with bad. The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. We. Lenders look at individuals with high credit scores as a low-risk of defaulting on payments, and will offer lower interest rates as a reward for good credit. Lenders offering car loans to people with a credit score may have specific requirements, such as a stable income, a down payment, or a co-signer to mitigate. What Credit Score Do I Need to Get a Good Deal on a Car? To get an auto loan without a high interest rate, our research shows you'll want a credit score of Auto Loan Tiers Based on Credit Scores · Super Prime rates are reserved for those with credit scores between · Prime rates are for those with a FICO. If you're in the market for a new vehicle, or even a used vehicle, you're probably wondering what kind of credit score you'll need to finance a car. Average Credit Score For Car Financing On average, Hendersonville drivers who are shopping for a new car have a credit score of for a new vehicle and As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able. Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. It's very possible to buy a car with bad. The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. We.

You can recover from bad credit through simple creditworthy behavior, such as paying your bills on time. And as this review of auto loans for a to Yes, it can—but only in certain cases. According to Equifax, when you co-sign for a loan, it is included in your credit history and is incorporated into your. What credit score is needed to buy a car in ? The average credit score to finance a car for drivers who bought cars in recent years was for new vehicles and for used vehicles. Even if you fall under. You can get a vehicle with a wide range of credit scores, but the average for a new vehicle is and the average for a used vehicle is Bad credit car. The average credit score of auto shoppers in is for a new vehicle and for a used car, along with other credit score categories which are broken. Superprime: to ; Prime: to ; Non-prime: to ; Subprime: to ; Deep Subprime: to Understanding Bad Credit Car Finance. Most people and most credit scores — good or poor — can get one. The catch is that, as a rule, a lower score means paying a higher interest rate for the loan. What's the Average Credit Score to Finance a Car? The average credit score of drivers who have been approved for auto loans in is for a new vehicle and. As you can see, a credit score puts you in the “good” or “prime” category for financing, making a good credit score to buy a car. While it's always a. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO. Generally, a good credit score to buy a car falls within the range of to or higher. However, it's important to note that each lender has different. You might not have the same options, but you can still get an auto loan with a credit score. Lender Considerations When Applying for an Auto Loan. When you. What Credit Score is Needed for a Car Loan for a New Vehicle? · – – % · – – % · – – % · – – % · – – %. For used car buyers, the average hovers around If your score is lower, remember that these are averages and that drivers with lower scores have secured. You don't need a specific credit score to buy a car, but higher scores mean lower interest rates. Navy Federal Credit Union explains how to get a lower. According to liveforexsignals.online, if you score between , you're still in the ballpark for getting a lease. However, while you're more likely to be approved. Lenders offering car loans to people with a credit score may have specific requirements, such as a stable income, a down payment, or a co-signer to mitigate. What credit score is needed to finance a car? There's no magic number, but higher credit scores are seen more favorably than lower credit scores by lenders. Average Credit Score For a New Car. How much credit do you need to buy a car? And what's the minimum credit score for Toyota financing? There are actually five.

Cost To Hire Someone To Stain Deck

The basic cost to Refinish a Deck is $ - $ per square foot in April , but can vary significantly with site conditions and options. Hiring a handyman, contractor, or deck company to clean and seal a deck average about $2-$ sq. ft. · For a DIY seal or stain, supplies can cost $20 to $ $$ Hiring a professional wood staining team is more expensive than DIY deck staining cost. But if you're a newbie and think you ruin. The cost to stain a deck varies depending on the amount of prep work needed, the deck size, and the type of stain selected. Most homeowners can expect to pay. Whether you hire us or someone else, in this article, we'll provide Cost-effective:** While hiring a professional deck staining company may seem. Staining, Sealing, and Waterproofing Costs · Pressure washing: Costs anywhere between $ to $ · Deck staining: Costs anywhere between $ to $1, Hiring a pro for deck staining ensures the job is done correctly, prevents accidents, and gives peace of mind. · The average cost to stain and seal a deck ranges. After taking all of the factors into consideration, the average cost to refinish a deck is $, according to HomeAdvisor. The lower end of that scale is $ The national average cost for deck staining ranges from $ to $ The average homeowner spends about $ on a 14' x 18' deck for cleaning, minor repairs. The basic cost to Refinish a Deck is $ - $ per square foot in April , but can vary significantly with site conditions and options. Hiring a handyman, contractor, or deck company to clean and seal a deck average about $2-$ sq. ft. · For a DIY seal or stain, supplies can cost $20 to $ $$ Hiring a professional wood staining team is more expensive than DIY deck staining cost. But if you're a newbie and think you ruin. The cost to stain a deck varies depending on the amount of prep work needed, the deck size, and the type of stain selected. Most homeowners can expect to pay. Whether you hire us or someone else, in this article, we'll provide Cost-effective:** While hiring a professional deck staining company may seem. Staining, Sealing, and Waterproofing Costs · Pressure washing: Costs anywhere between $ to $ · Deck staining: Costs anywhere between $ to $1, Hiring a pro for deck staining ensures the job is done correctly, prevents accidents, and gives peace of mind. · The average cost to stain and seal a deck ranges. After taking all of the factors into consideration, the average cost to refinish a deck is $, according to HomeAdvisor. The lower end of that scale is $ The national average cost for deck staining ranges from $ to $ The average homeowner spends about $ on a 14' x 18' deck for cleaning, minor repairs.

Painting a deck can cost you $ to $2, or $2 to $5 per square foot. On average, painting a square-foot surface costs $1,, although the cost might. The following prices are ballpark prices only. The size of your house or deck, the number of colors, number of coats, geographic location, the amount of. R to R to stain a medium-sized deck. R to R to stain a larger deck. Working with a Decking Expert. When hiring a decking expert, ensure they. On average, it costs $ to $ per square foot to clean, stain, and paint a deck. Contact Rent Painters for a consultation and quote. Are there. While prices vary, in general expect to pay around $3 to $5 per square foot for deck staining services regardless of the deck's size. . The exact cost for. According to Angi, hiring a professional deck refinishing company to resurface a square-foot deck typically costs between $ and $1, I can't give you an exact figure but using acid stain it can be done pretty cheaply. The cost is dependent on coverage of stain. Sometimes you. Average cost to re-paint a deck is about $ ( liveforexsignals.online deck - partial DIY). Find here detailed information about deck painting costs. Deck Staining Service Prices. Staining prices can vary. Factors which affect It is ideal to have someone there for the start of the project. What. Prices for deck painting and staining run about $2-$5 per square foot, depending on the size and condition of your deck. The type of paint or stain you choose. The cost to stain a deck ranges from between $ and $1, The labor costs are, on average, between $ and $4 per square foot. However, deck staining. The average cost to stain a deck starts at about $ per square foot for DIY and up to $ per square foot when hiring a pro. Staining and sealing your deck every few years keeps it looking fresh, prevents fading, and preserves it against the elements. The cost of a sealer and stain. When combined with wood deck refinishing (staining or sealing), the total cost is typically $–1,, or $– per square foot. Labor costs make up. The type of stain used is another factor that will affect the cost of deck staining. Different types of stains offer varying levels of protection and can range. For the staining portion of the deck, avg. prices are $ and up. All wood decks have to be cleaned and sanded very well before stain can be applied. Estimated final cost for deck staining ; Deck Labor, Hours, $ ; Deck Job Materials and Supplies, Square Feet, $ ; Totals - Cost to Stain Decks -. The cost to stain a deck varies depending on the amount of prep work needed, the deck size, and the type of stain selected. Most homeowners can expect to pay. The average cost to build a deck is $30 – $60 per square foot. This includes your decking material, extras like hardware, beams, and balusters, and labor costs.